News

ADG Legal news. You can find the latest legal industry news, updates from our law firms, and professional insights from our legal professionals here.

Check our events page for regular updates on industry events in the legal and business fields.

-

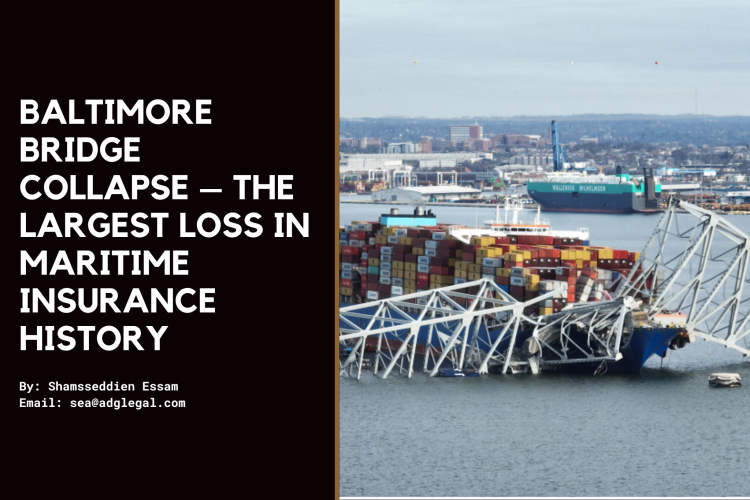

Baltimore Bridge Collapse – The Largest Loss in Maritime Insurance History

-

Charging interest on loans in the UAE

-

INSIGHTS INTO THE NEW MARITIME LAW

-

Diversity and Inclusion in ADG Legal

-

THE UAE OPENS THE GATES WIDE FOR MARINE VESSELS REGISTRATION UNDER THE NEW MARITIME LAW

-

Relocating to Dubai: A snapshot guide to making the move

-

The Crime of Aggression: A Dual International Legal Responsibility and the Global Shift in Criminal Jurisdiction – Chapter 3 & the last : The International Criminal Court’s Pursuit of Accountability for the Crime of Aggression

-

The Procedures of Precautionary Attachment Over Marine Vessels Between State Courts and Arbitration Tribunals

-

The Multiplicity of Claims and the jurisdictional threshold Assessment

-

The Crime of Aggression: A Dual International Legal Responsibility and the Global Shift in Criminal Jurisdiction – Chapter 2: The Definition of Aggression in International Law: Perspectives and Controversies

-

The Travel Ban System in the United Arab Emirates.

-

The Crime of Aggression: A Dual International Legal Responsibility and the Global Shift in Criminal Jurisdiction

-

Navigating Foreign Judgment Enforcement in the UAE: A Comprehensive Overview

-

Sale of Real Estate Off-Plan in accordance with the Real Estate Legislation System in the Emirate of Dubai

-

Customs Insights: Duty Free

-

Personal Status Law for non-Muslim

-

The Organized Crime in the UAE

-

UAE Labour Law

-

Navigating Dubai’s Rental Regulations: A Guide for Landlords and Tenants

-

Article 8, Paragraph 3 of the Civil Procedures Law

-

Customs Broker

-

Trademark

-

Phishing Scam in the UAE

-

A brief overview on doing business in the United Arab Emirates

-

Lawyer Peter Gray positions ADG Legal as a global catalyst in UAE

-

Free Zones and Duty-free Shops

-

Goods in accordance with the GCC Common Customs Law

-

Blood Money

-

#CustomsInsights

-

ARAB TIMES: ADG Legal Founder Peter Gray on Legal Reform and Development in the UAE

-

AFRICA BUSINESS INSIDER: Unlocking New Horizons: ADG legal and advisor Peter Gray’s growing investments shaping the future of Africa

-

ADG’s Africa Practice

-

Ministerial Decision No. 114 of 2023 on the Accounting Standards and Methods for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses

-

ADG Legal Welcome’s New Partner Paul Bugingo

-

Family Business

-

Legal Framework of Customs Operations in the UAE – an Overview

-

What is the official retirement age for expats in the UAE?

-

Employers’ rights under the new labour law

-

Do you own any property in the UK that is not registered in your own name? Act fast to avoid a fine or imprisonment.

-

UAE: Can I work for another company during my annual leave?

-

Dubai Courts to enforce judgments issued by English courts based on the principle of reciprocity

-

A Practical Guide to Navigating International Financial Sanctions Rules in the UAE

-

My employer has denied my annual leave, can I encash it instead?

-

Renting in Dubai: Was your house demolished? You have the right to return after reconstruction

-

ADG LEGAL WELCOME’S NEW PARTNER JOHN PODGORE

-

New UAE Cybercrimes law: Do you know what can land you in trouble?

-

Federal Decree No. 15 of 2022 ratifying the Common Customs Law for the Gulf Cooperation Council and Rules of Implementation

-

Dubai Financial Services Authority Approves Legislative Amendments regarding whistleblowers

-

The 2022 DIAC Arbitration Rules – A new age for Dubai Arbitration or merely a face lift?

-

Dubai Virtual Asset Regulation Law: What we know so far?

-

Potential Legal Issues Associated with Consent under the UAE Federal Data Protection Law

-

New UAE Corporate Tax

-

UAE: Sick leaves, work-from-home during Covid-19; Know Your Right’s

-

UAE criminal law reforms, Mohammed’s response on Khaleejtimes

-

ADG Legal welcomes the ABCC, business mission in the UAE

-

An international tax framework triggering the most significant changes to the international tax rules in the last 100 years: tax reforms to come in 136 countries for the next few years!

-

Botswana and Mauritius are no longer subject to increased scrutiny by the EU/EC FATF (21 October 2021)

-

Online Private Notary Services

-

حكم إشهار إفلاس شركة مساهمة عامة ومسؤولية أعضاء مجلس الإدارة

-

WOMEN IN THE UAE, THE STARS ARE THE LIMIT: FEMALE BOARD REPRESENTATION IN UAE COMPANIES

-

Interview with Mohammed Al Dahbashi

-

ADG Legal partners with Evolving’ women to drive women empowerment

-

Mohammed Al Dahbashi to speak on the panel at the UK-Middle East Legal Services Week

-

DMCC Crypto centre to revolutionize digital currency

-

EID AL FITR 2021: UAE COVID LAWS

-

CRYPTO ASSETS IN THE UAE REGULATIONS

-

UAE RAMADAN 2021: DUBAI AND ABU DHABI RAMADAN AND COVID LAWS

-

IMMUNISE AGAINST CONSTRUCTION DISPUTES: A GUIDE TO BETTER DISPUTE OUTCOMES

-

Season’s Greetings from the ADG Team

-

UAE ANNOUNCES 100% FOREIGN COMPANY OWNERSHIP

-

ADG Legal Expands its Construction Team in Dubai

-

Update – New Data Protection Law, DIFC Law No. 5 of 2020

-

Egypt’s Economic Transformation

-

DIFC Employment Law Update – Presidential Directive on COVID-19

-

Investment Opportunities in Sudan

-

Amendments to the Bankruptcy Laws in the UAE

-

Restructuring in the Era of COVID-19

-

Can Cases Still be Filed in Dubai Courts During COVID-19 Restrictions?

-

Pressure on UAE Contractors to Re-Price Projects: Hostages to Fortune?

-

New Commercial Courts In Abu Dhabi

-

COVID-19 Employment Law Update: Common Questions Answered for the UAE

-

MOHRE’s Decision in Response to COVID-19

-

Effects of COVID-19: Cross-Border Contracts and ADG’s Dedicated Advice Hub

-

Managing Cross Border Risk, a Collaboration with IR Global

-

Roberto Cornetta and John Leopoldo Fiorilla Join the Team

-

New Employment Regulations Issued by ADGM

-

ENFORCING AN ARBITRATION AWARD IN THE UAE

-

UPDATE – DIFC Issues New Amendments to its Employment Law (Law No. 2 of 2019)

-

Will the DIFC’s New Workplace Savings Scheme be a Positive Change?

-

UPDATE – DIFC Wills Expand Outside of Dubai

-

Somalia – The Next Investment Opportunity?

-

New Decision Allows Some Cases to Stop at Prosecution

-

UPDATE – Snapshot Of Changes Under New DIFC Employment Law

-

UPDATE – FDI in UAE

-

Recent Amendments to the Civil Procedure Code

-

Djibouti and DP World – Only Mediation Can Really Solve What Is A Political Dispute

-

The Differences Between Arbitration and Litigation In The UAE

-

Is UAE Arbitration now restricted to local lawyers?